How we invest

Investment Strategy

The Fund intends to allocate loans to partner financial intermediaries (PFIs) in the proportions outlined below:

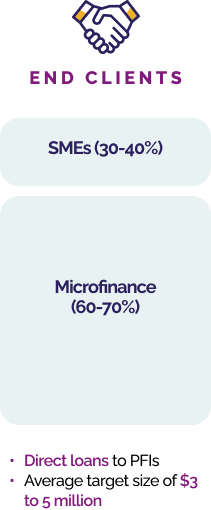

End clients

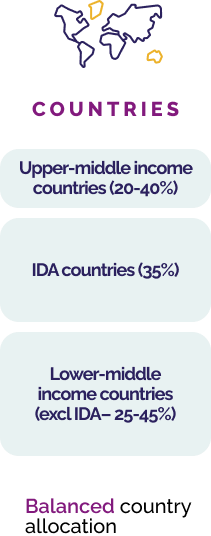

Countries

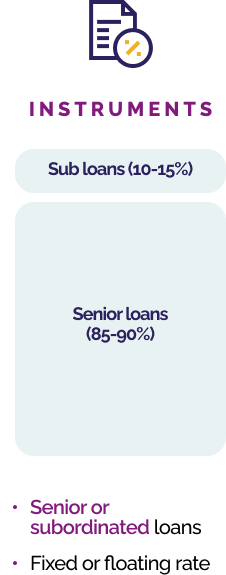

Instruments

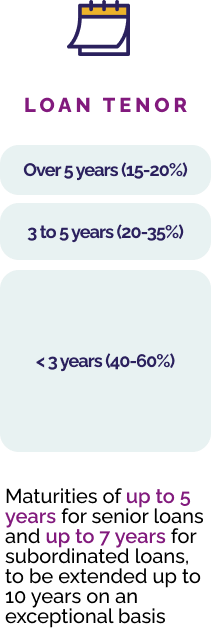

Loan tenor

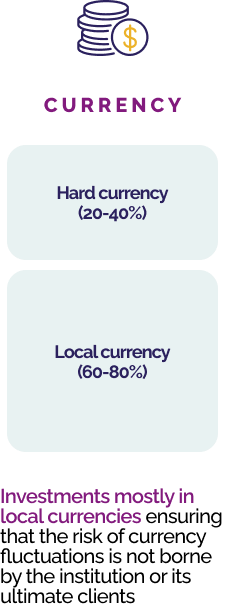

Currency

SMEs (30-40%)

Microfinance

(60-70%)

Upper-middle income

countries (20-40%)

IDA countries (35%)

Lower-middle

income countries

(excl IDA– 25-45%)

Sub loans (10-15%)

(85-90%)

Over 5 years (15-20%)

3 to 5 years (20-35%)

< 3 years (40-60%)

(20-40%)

Local currency

(60-80%)

- Direct loans to PFIs

- Average target size of $3 to 5 million

Balanced country allocation

- Senior or subordinated loans

- Fixed or floating rate

Maturities of up to 5 years for senior loans and up to 7 years for subordinated loans, to be extended up to 10 years on an exceptional basis

Investments mostly in local currencies ensuring that the risk of currency fluctuations is not borne by the institution or its ultimate clients

How will we address

the problems identified?

- Leveraging capabilities of three industry-leading Portfolio Managers

- Supports to PFIs that

- demonstrate a gender-smart strategy or

- show a strong intentionality and commitment to deploying gender-smart measures going forward

- Financial assessment to ensure good credit quality of PFIs

- Detailed gender assessment conducted for every potential investment

- Management commitment at the level of the PFI to develop and implement a gender-smart strategy, either internally or externally, or both.

- Gender Action Plan with clear targets for all projects (legally binding)

- Gender Action Plan implementation monitored on a quarterly basis

- Collection of gender KPIs

- Financing earmarked for MSMEs and eligible consumer loans with at least 80% of the financing allocated to Target Clients.

- Support to selected PFIs through technical assistance in order to achieve the targets set out in the gender action plan.

Possible renewal of financing provided Gender Action Plan has been completed and use of proceeds condition has been met

How will we address

the problems identified?

Possible renewal of financing provided Gender Action Plan has been completed and use of proceeds condition has been met

Outreach through Partner Financial Institutions (PFIs)

Goal

Each PFI can become Gender-Smart with GGSF support

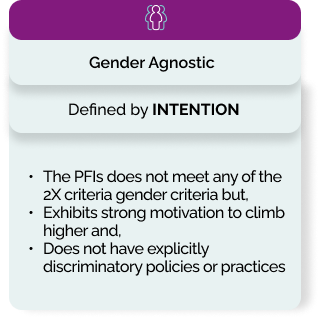

Gender Agnostic

Defined by INTENTION

- The PFIs does not meet any of the 2X criteria gender criteria but,

- Exhibits strong motivation to climb higher and,

- Does not have explicitly discriminatory policies or practices

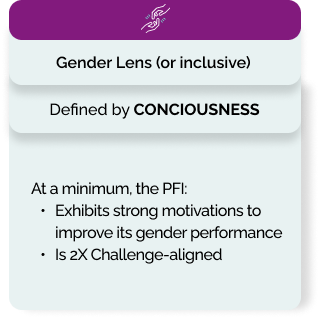

Gender Lens (or inclusive)

Defined by CONCIOUSNESS

At a minimum, the PFI:

- Exhibits strong motivations to improve its gender performance

- Is aligned with 2X Criteria

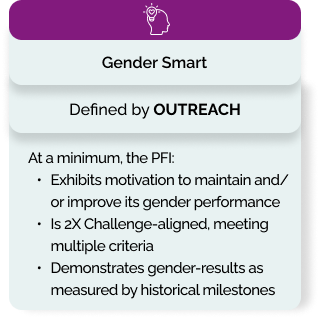

Gender Smart

Defined by OUTREACH

At a minimum, the PFI:

- Exhibits motivation to maintain and/or improve its gender performance

- Is aligned with 2X Criteria

- Demonstrates gender-results as measured by historical milestones

Outreach through Partner Financial Institutions (PFIs)

Technical assistance

The Fund strategy will be complemented by a Technical Assistance Facility which will empower the financial institutions to better benefit from the funding.